Table of Contents

End harassment from RCS Capital Partners

Is RCS Capital Partners harassing you over your defaulted loan and the repayment options available to you?

Because you may be receiving calls right now, you may not realize that debt collectors have their collection tactics closely monitored by the FDCPA (Fair Debt Collection Practices Act), thus, they are limited in the context of what they can and cannot do in the context of debt collection.

Therefore, if you have fallen behind on your bills, and are currently in touch with a debt collection organization, it is important to remember that you have rights which deserve to be respected. If a collector violates the FDCPA, you can sue the collector in court. The law allows consumers who have been victims of harassment from debt collectors to get the calls to stop in addition to recover statutory damages of up to $1,000, plus attorney fees and court costs.

4 ways RCS Capital Partners may be breaking the law

Do you know that RCS Capital Partners may be breaking the law in trying to get you to resolve your debt quickly? Even though RCS Capital Partners is entitled to collect the debt you owe them, they are not allowed to use whatever means they deem necessary to get payments out of you. Below are the top 4 ways you may never have imagined that RCS Capital Partners could be violating your consumer rights.

- Calling you at inconvenient times: Does the representative from RCS Capital Partners call you too early when you have barely gotten out of bed, too late, or at your place of employment? The fact that you owe a debt collection agency a debt doesn’t give them the right to invade your privacy whenever they please. doing so could be a serious violation of the FDCPA laws.

- Embarrassing you: As stated earlier, the fact that you owe RCS Capital Partners a debt doesn’t mean that they have a right to treat you as they please. Another way that RCS Capital Partners may be breaking the law is if they embarrass you over your unsettled debt. This embarrassment may come in the form of a belligerent tone, hurling insulting words at you, telling unauthorized persons about your unresolved debt, and even showing up at your workplace. These acts are highly inconvenient and are thus against the law.

- Feeding you wrong information: It is not uncommon for debt collection agencies to misinterpret the information contained on a customer’s account. They often (deliberately or not) misread the loan figures or interest rates on the loan. However unintentional this may be, it is still illegal.

- Bypass your attorney: If you have legal representation, your debt collection representative is not permitted to bypass them and communicate directly with you. Doing so would be to carelessly flout the law.

Are there other laws that protect your rights?

Yes. The FDCPA and TCPA were signed into law primarily to protect consumers like you from the malicious tactics employed by many debt collection agencies in the process of debt collection.

These laws protect you by laying down strict guidelines that debt collectors must adhere to when trying to get you to pay up a debt, and makes provisions for you to take legal action against any erring debt collection agency.

Want to know more about the FDCPA and TCPA laws and how they protect you? Read all about it here and here.

About RCS Capital Partners

RCS Capital Partners is a third-party debt collector located in Amherst, New York. It is a full-service company, licensed to manage consumer assets with a more intent focus on recovering debts that have gone into default.

Contact Information

3840 E Robinson Rd Ste 447

Amherst, NY 14228-2001

Website:

Phone: 855-764-8861

Complaints against RCS Capital Partners

As at the time this article was written, there are currently 16 complaints against RCS Capital Partners with the Better Business Bureau. In a recent complaint brought against the company by an affected consumer, RCS Capital Partners was guilty of mistaking the consumer’s identity with that of another person simply because they had the same name.

The consumer goes on to state that the representative “blurted out” a social security number that wasn’t hers, and when she informed the representative that it was only a name coincidence, she was accused of using someone else’s social security number to carry out fraudulent activities. Even when contacted by a different representative, the error was not corrected, instead, she was mailed paperwork regarding a debt she did not owe.

If you are being harassed by RCS Capital Partners in a similar manner, do not hesitate to call us now on 844-791-1990

Frequently asked questions about RCS Capital Partners

- I didn’t borrow money from RCS Capital Partners, why are they calling me to collect a debt I took elsewhere?

Answer: RCS Capital Partners is most likely calling you because your account with your original lender has been in default for a long time, hence, it has been transferred or sold to RCS Capital Partners.

- Is RCS Capital Partners a scam?

Answer: No. According to the Better Business Bureau, RCS Capital Partners is a legitimate collection agency that has been in business since 2016.

- Can I bypass my debt collector and make payments to my original lender?

Answer: No. Even if you do, your original lender will either reject your payment or have it transferred to RCS Capital Partners so why bother?

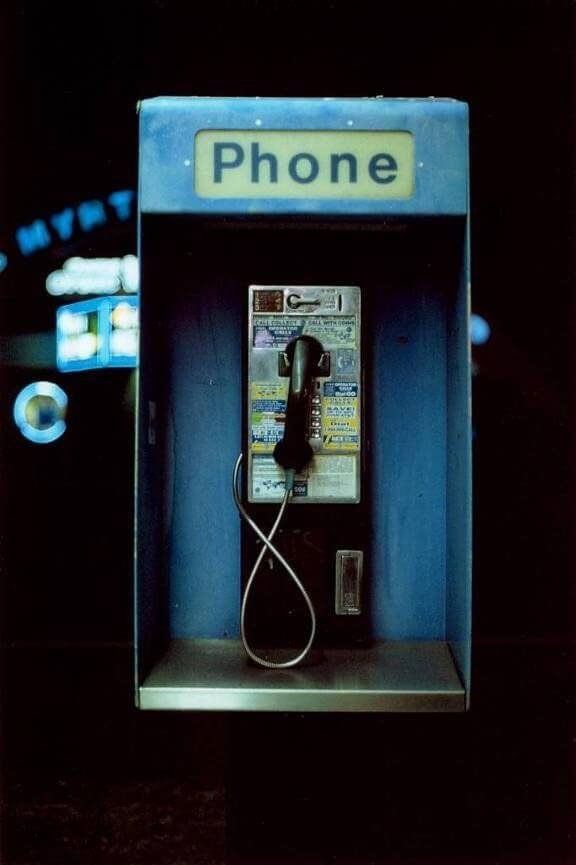

About this site (Telephone Harassment)

We are here to fight for you in cases of debt collection harassment. Read all about it here.

Call us now on 844-791-1990

Beware! RCS Capital Partners uses the following numbers to contact consumers:

855-764-8861

866-381-6899

RCS Capital Partners BBB Information

BBB file opened: 11/21/2016

Consumer Rights Law Firm Center BBB information

BBB Rating: A+

https://www.bbb.org/us/ma/north-andover/profile/lawyers/consumer-rights-law-firm-0021-124253